The difference between term and whole life insurance is that term life insurance is cheaper and covers you for a set period of time, while whole life insurance usually costs much more but can last your entire life. Whole life insurance can also build cash value that you can borrow against, which makes it a more complex and expensive product.

With either policy, your loved ones can spend the payout however they like, such as funeral expenses, mortgage payments or college tuition. But depending on your coverage needs, one type of life insurance may be a better fit than the other.

Term life vs. whole life insurance: Overview

To better understand the difference between term life and whole life, here’s a quick rundown on how each type of coverage works.

Term life insurance

The way term life insurance works is simple: It covers you for a fixed period of time, such as 10, 20 or 30 years, and pays out if you die during the term. If you outlive the term and your coverage ends, your beneficiaries won’t receive any money. Most policies are a type of level term life; the death benefit and life insurance premiums are guaranteed to stay the same throughout the term. A decreasing term life policy is slightly different, and less common. The life insurance death benefit gets smaller over the length of the term while the premiums stay the same.

Ideally, the length of your term life insurance should match the financial obligation you’re covering. For example, if you’re a new parent, you might buy a 20-year policy to cover you until your child no longer relies on you financially. Most life insurance companies sell term life, so it’s easy to find and compare life insurance quotes online.

Whole life insurance

Whole life insurance is the most common type of permanent life insurance and typically costs more than term life. This is because most policies offer coverage that lasts until much later in life, such as until 90, 100 or 120 years old. Whole life insurance also has a cash value component. A portion of your premium goes toward the cash value, which can grow over time. Once you’ve built up enough cash value, you can borrow against it or surrender the policy for cash.

Although it’s more complicated than term life, the way whole life insurance works is more straightforward than other types of permanent life insurance. Premiums remain level and the cash value grows at a guaranteed fixed rate. The death benefit is also guaranteed, but be mindful of taking out cash value loans or withdrawals without paying them back. While you’re not required to repay them, your insurer will subtract any outstanding loans or withdrawals from the final death benefit paid out to your beneficiaries.

Many whole life policies are “participating” life insurance policies, which means you may earn dividends based on the company’s financial performance. You can use your dividends in a few different ways — including boosting your policy’s cash value.

Cost of whole life insurance vs. term life insurance

Cost is a major difference between whole and term life insurance. Term life is often the most affordable life insurance because it’s temporary and has no cash value. Whole life premiums are much higher because the coverage typically lasts your lifetime, and the policy grows cash value. Here’s how annual premiums compare for term life policy vs. whole life.

Average annual rates for term life vs. whole life

These sample rates reflect the average annual premiums a non-smoker in excellent health would pay for $500,000 in coverage for both term and whole life policies.

How to choose between term and whole life insurance

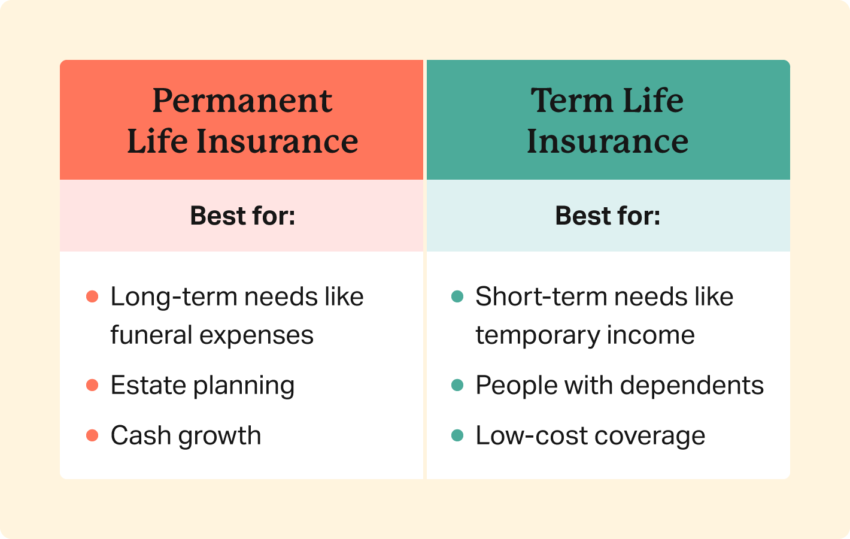

Term life is sufficient for most families, but whole life and other forms of permanent coverage can be useful in certain situations.

Choose term life if you:

- Only want coverage for a specific period of time. A term life policy can replace your income if you die while you still have major financial obligations, such as raising children or paying off your mortgage.

- Want the most affordable coverage. Term life insurance is the least expensive option, especially if you’re young and healthy.

- Think you might want permanent life insurance but can’t afford it right now. You may be able to convert your term life policy to permanent coverage at a later date. The deadline for conversion varies by policy, and not all policies offer conversion.

- Don’t want to use life insurance to accumulate a cash value. Buying a cheaper term life policy lets you save what you would have paid for a whole life policy, and perhaps invest the money elsewhere.

Choose whole life if you:

- Can comfortably afford the higher premiums. Whole life insurance is a lifelong commitment, so you want to make sure you can afford it. If you miss your premium payments, your policy could lapse.

- Want coverage that essentially lasts your lifetime. The death benefit from whole life policies typically pays out whenever you die. If you name life insurance beneficiaries on your policy, the payout will go directly to them and not through your estate.

- Have a lifelong dependent like a child with disabilities. Life insurance can fund a trust to provide care for your child after you’re gone. Consult with an attorney and financial advisor before setting up a trust.

- Want life insurance that builds guaranteed cash value. The cash value of whole life policies grows at a guaranteed rate set by the insurer.